The integration of a Title Loan Spanish Application streamlines loan processes for non-English speakers, offering clear communication and documentation in their native language. This digital approach expedites funding through automated checks and efficient data collection, enhancing customer satisfaction and underwriting efficiency. By bridging the gap between borrowers and lenders, it ensures informed decisions, transparent terms, flexible payments, and protections against abusive lending tactics, particularly for those facing financial challenges in a new language.

Legal experts recommend utilizing a Title Loan Spanish Application to streamline loan processes, particularly in diverse communities. This application plays a pivotal role in ensuring accurate communication by overcoming language barriers, thereby protecting borrowers’ rights from potential legal pitfalls. By adopting this approach, lenders can facilitate access to financial services for a broader span of individuals while maintaining adherence to legal standards.

- Streamlining Loan Processes: Spanish Application's Role

- Ensuring Accurate Communication: Language Barriers Overcome

- Protecting Borrowers' Rights: Legal Perspective

Streamlining Loan Processes: Spanish Application's Role

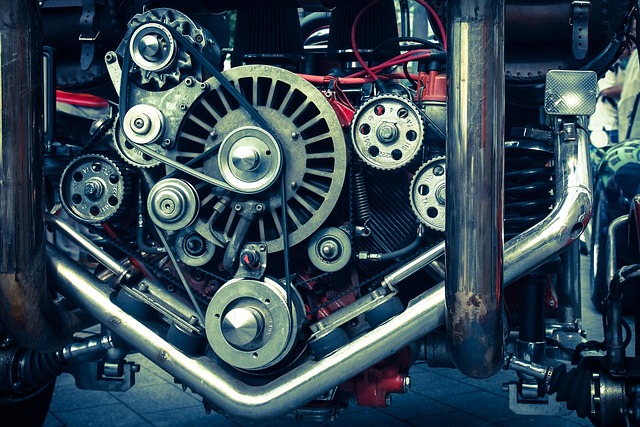

The integration of a Title Loan Spanish Application has revolutionized the way legal experts and financial institutions manage loan processes, particularly for non-English speakers. By streamlining communication and documentation, this application serves as a crucial tool in simplifying the often complex title loan process. It allows borrowers to initiate and complete their applications in their native language, ensuring clarity and minimizing potential errors or misunderstandings.

This digital approach facilitates quick funding by automating initial checks and gathering essential information efficiently. The application acts as a bridge between borrowers and lenders, making the entire title pawn process more accessible and convenient. Consequently, it not only improves customer satisfaction but also enhances the overall effectiveness of loan underwriting and approval procedures.

Ensuring Accurate Communication: Language Barriers Overcome

Effective communication is a cornerstone of any legal transaction. When it comes to securing a title loan, ensuring clarity and understanding across different linguistic backgrounds is paramount. This becomes particularly significant with the growing demographic diversity, where many borrowers may not be proficient in English but are fluent in Spanish.

The introduction of a Title Loan Spanish Application serves as a bridge, facilitating seamless interaction between lenders and borrowers. By offering application materials in Spanish, individuals who speak the language can confidently navigate the title loan process. This simple step overcomes language barriers, ensuring that every borrower understands their rights, obligations, and the vehicle collateral implications of the title pawn agreement.

Protecting Borrowers' Rights: Legal Perspective

When considering a Title loan Spanish application, understanding your rights as a borrower is paramount. This is especially true in a language that may be new to you, making clear communication and protection even more critical. Legal experts emphasize that borrowers should familiarize themselves with state laws governing these loans to ensure fair practices. Such regulations often include provisions for transparent terms, flexible payments, and protections against abusive lending tactics.

For instance, in the case of Emergency Funds or unexpected expenses, a reputable lender offering Truck Title Loans should provide clear paths to repayment without excessive penalties or harassment. This includes reasonable interest rates, understandable fee structures, and the right to cancel within a specified period. Borrowers should never feel pressured into terms they don’t understand or cannot afford—knowing their rights enables them to make informed decisions, ensuring a safer borrowing experience, especially when navigating financial challenges in a new language.

The implementation of a dedicated title loan Spanish application streamlines loan processes, overcomes language barriers, and fortifies borrower protections. By utilizing this tool, lenders can ensure clear and accurate communication with Spanish-speaking borrowers, fostering trust and compliance with legal standards. This innovative approach not only enhances the overall lending experience but also promotes fairness and transparency in the financial sector.