To apply for a Title Loan Spanish, understand the process, gather documents (ID, vehicle registration, income proof), calculate repayment terms using the built-in loan calculator, accurately complete the form, and double-check for errors before submission. This ensures transparency, favorable loan terms, and secure access to emergency funds through your vehicle as collateral.

The process of applying for a Title Loan in Spanish can be streamlined with features that simplify and accelerate the journey. One notable inclusion is a built-in loan calculator, enhancing transparency and user experience. This article delves into the intricacies of the Title Loan Spanish application, highlighting the significance of this calculator in understanding repayment terms. Learn how to navigate and complete your application effortlessly, ensuring a smooth path to securing your loan needs.

- Understanding the Title Loan Spanish Application Process

- The Importance of a Built-in Loan Calculator

- How to Navigate and Complete Your Application Effortlessly

Understanding the Title Loan Spanish Application Process

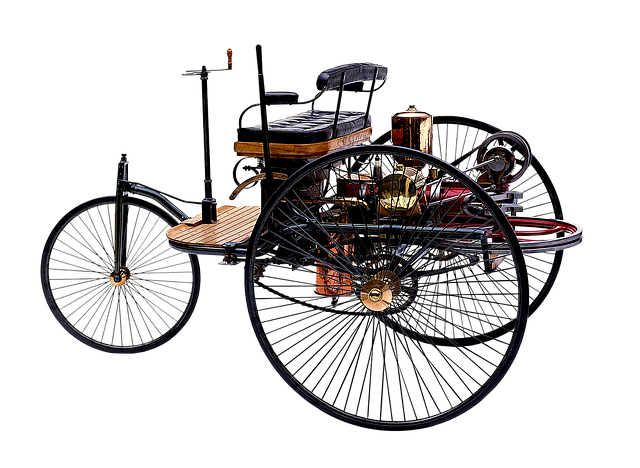

When it comes to understanding the Title Loan Spanish application process, the first step is to familiarize yourself with the various components involved. This typically includes providing personal information such as your name, address, and employment details. You’ll also need to demonstrate ownership of a vehicle, as these loans are secured against your vehicle’s title. The application usually includes a loan calculator that allows you to estimate the amount you can borrow based on the value of your vehicle.

This process is designed to ensure transparency and fairness. Lenders will assess your ability to repay the loan by considering your income and existing financial obligations. It’s crucial to be honest about your financial situation, as this directly impacts your loan approval chances and the interest rates offered. Keep in mind that maintaining control over your vehicle throughout the loan period is key; emergency funds can be accessed quickly if needed, while still enabling you to keep your vehicle.

The Importance of a Built-in Loan Calculator

In the context of a Title Loan Spanish application, a built-in loan calculator is an indispensable tool that simplifies the process for borrowers. This feature allows potential lenders and borrowers to quickly estimate repayment terms and interest rates with ease, fostering transparency and trust. By inputting basic loan details, such as the vehicle’s value and desired loan amount, the calculator provides instant results, enabling users to make informed decisions about their financial obligations before submitting an official application.

This functionality is particularly beneficial for individuals navigating Car Title Loans, as it facilitates a more transparent evaluation of the terms offered. Online Application processes are made smoother with such calculators, ensuring borrowers understand the implications of their loan choices. Moreover, this tool empowers them to compare various loan options side by side, ultimately leading to better financial management and decision-making during the application stage.

How to Navigate and Complete Your Application Effortlessly

Navigating a Title Loan Spanish application might seem daunting at first, but with a clear understanding of the process, you can complete it effortlessly. Start by gathering all necessary documents, such as your vehicle registration and proof of income, to streamline the verification step. Fill out the form accurately, providing detailed information about your vehicle ownership and ensuring all data is correct to avoid delays later in the title loan process.

Use the built-in loan calculator to estimate your repayment terms and understand how much you’ll be paying back over time. This tool is a valuable asset that helps you make an informed decision. Once complete, double-check your work for any errors; then submit it, and one of the representatives will guide you through the next steps, ensuring a smooth loan payoff experience.

When completing a Title Loan Spanish application, having a built-in loan calculator is invaluable. This feature simplifies the process by instantly providing loan amounts and terms based on your vehicle’s value, ensuring you understand the full scope of your potential loan before finalizing your request. By seamlessly integrating this tool, lenders make it easier for borrowers to navigate and complete their applications effortlessly.